Reno’s Multifamily Pipeline Is Drying Up—Here’s Why It Matters

.jpg?width=50&name=DZ9A5684%20(1).jpg) By

Jake Andronico

·

2 minute read

By

Jake Andronico

·

2 minute read

Northern Nevada's Multifamily Construction Pipeline Is Drying Up Fast: What This Means for the Reno Market

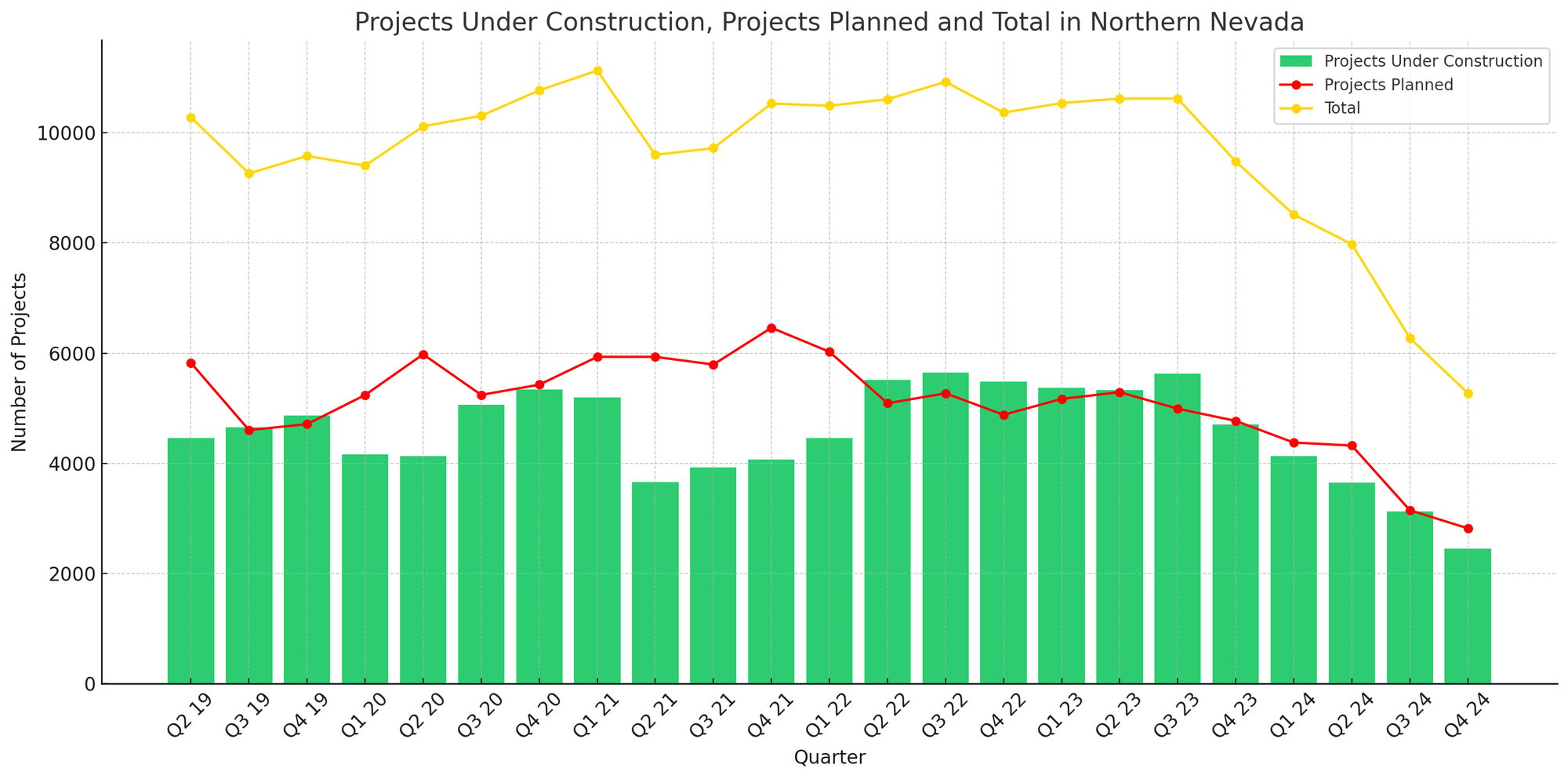

If you’ve been tracking Northern Nevada’s multifamily pipeline, the latest numbers paint a clear picture—and it's not a pretty one. The number of projects under construction, planned, and total has dropped significantly since 2022. For Reno, this isn’t just a development story—it’s a rent growth and supply-demand story in disguise.

Let’s break it down and look at what this means for developers, investors, and renters.

Multifamily Starts Are Collapsing in Reno—Here’s the Proof

Just two years ago, Northern Nevada was humming along with more than 10,000 total multifamily units either planned or under construction. Fast forward to Q4 2024, and the total pipeline has shrunk to just over 5,000 units—cut in half.

-

Projects Under Construction: Down from a 2022 peak of ~5,600 to just 2,500 in Q4 2024.

-

Planned Projects: Also down significantly, dipping below 3,000 for the first time in years.

-

Total Pipeline: From a high near 11,000 to just 5,200.

That’s not a slowdown. That’s a cliff.

Why Are Multifamily Starts Drying Up?

There’s a perfect storm brewing behind the scenes:

-

Higher interest rates have made new development less feasible.

-

Construction costs remain elevated.

-

Tighter lending standards have frozen capital for new starts.

-

Market uncertainty post-2022 has developers pulling back.

What’s more, many projects that were in the “planned” stage are now stalled indefinitely—or scrapped altogether.

What This Means for Rent Growth

In simple terms: Reno's rent pressure isn’t going away.

Despite all the talk of softening rents nationwide, Northern Nevada's shrinking pipeline suggests limited new supply is on the horizon. That gives existing landlords and investors a lot more pricing power in the years ahead.

Expect this tightening supply to lead to:

-

Upward rent pressure in 2026 and beyond

-

Lower vacancy rates across stabilized properties

-

A renewed investor appetite once cap rates settle

In other words, if you already own in Reno, you’re sitting in a good spot. If you’re looking to buy, the next 12–18 months may offer a rare opportunity—before the next wave of demand collides with a lagging supply response.

Developers: Watch the Timing

If you’re a developer sitting on entitled land in Reno or Sparks, timing your next start will be everything. Right now, the market is frozen—but once rates ease or construction costs stabilize, we may see a rapid rebound in demand to build.

And remember: the pipeline isn’t just lower. It’s aging. Many of the "planned" projects on this chart have sat stagnant for years. Some may never get built.

That means any new start in late 2025 or early 2026 could hit the market with a serious first-mover advantage.

Institutional Investors Are Paying Attention

Wall Street doesn’t look at one property at a time—they watch entire markets. And the signals in Reno are loud:

-

Supply pipeline is drying up

-

Population and job growth remain healthy

-

Long-term fundamentals still strong

Expect institutional capital to start circling back to Reno soon. And when they do, they won’t be underwriting “today’s rents”—they’ll be forecasting tomorrow’s tight supply and upward pressure.

Final Thought: Reno's Quiet Inflection Point

We’re entering a rare window in Northern Nevada—one where the headlines may say “slowdown,” but the smart money sees opportunity. Whether you’re an investor, developer, or operator, the current pause in construction is your signal to pay attention.

Because when the pipeline shrinks this fast, it’s not just a development story—it’s a rent growth setup.

Want to explore the data behind the chart or talk multifamily strategy in Reno? Let's connect.